Navigating the Delhi real estate scene in 2025 can be a major choice, specifically for New Comers and First time Buyers. Home rates have actually been trending upwards with stable recognition, while rental fees remain to rise due to rising cost of living and demand. At the same time, mortgage interest rates have actually dipped, and federal government real estate plans offer some relief. This mix of elements makes the option between buy property in Delhi or renting out a complicated yet vital one. The appropriate decision relies on your funds, strategies, and way of living.

Introduction of Getting Property in Delhi in 2025

Existing Market Trends and Rate Gratitude

Delhi’s real estate market is showing about a 6.5% annual rate growth. Demand is solid in household hotspots such as South Delhi, Dwarka, and Gurugram residential areas. The market favors well-connected localities with good facilities and schools, bring in families and professionals.

Investments in framework and city developments have actually increased price recognition. According to recent records, high-end residential projects in South Delhi saw a 31% price hike in 2025 alone, while mid-range residential or commercial properties in creating areas remain more inexpensive however steadily increasing.

Financial Factors To Consider for Purchasing Residential Property

Purchasing residential property means managing in advance costs like a deposit (frequently 10-20%), stamp responsibility (typically 5-8%), and enrollment costs. Regular Monthly Equated Monthly Installments (EMIs) rely on the financing quantity and rate of interest. The home mortgage interest rates currently float between 8.10% and 8.75%, which makes obtaining much more budget-friendly than in previous years.

While first prices are high, federal government efforts like the Pradhan Mantri Awas Yojana (PMAY) offer aids that profit qualified buyers. Remember to consider maintenance charges and occasional repair work.

Advantages of Getting Residential Or Commercial Property

Possessing a home indicates long-lasting stability– your home, your guidelines. You construct equity rather than paying rent that disappears monthly. With building ownership, resources gratitude over time can grow your financial investment value. Plus, property owners enjoy tax obligation breaks on finance rate of interest and principal repayment.

Purchasing also secures you from rental fee hikes and assists develop a monetary asset that can be passed to your family.

Challenges and Risks in Buying Property

The biggest difficulty is the high first financial investment and ongoing maintenance costs. Real estate markets can likewise fluctuate– rates might soften due to economic declines or excess. Liquidity can be an issue if you need to market promptly, as residential or commercial properties require time to discover buyers.

Also, in spite of the simplicity of home loans, a missed EMI can hurt your credit history and result in lending charges.

Overview of Renting in Delhi in 2025

Rental Market Dynamics and Price Implications

Rental rates in Delhi have increased by 7.5-10% yearly in essential areas such as Connaught Area, Karol Bagh, and Jasola. Usually, monthly rents may float about 15,000 to 40,000 depending on the place and property kind. Deposits typically require 2-3 months’ lease upfront.

Renting deals versatility in moving or downsizing and prevents the high down payment related to purchasing.

Benefits of Renting Property

Renting out entails lower upfront costs and no worries about building maintenance or repairs. For someone new to Delhi or unsure about staying long-term, leasing supplies freedom without locking in a residential property. It’s simpler to switch over places based on job or way of life requirements.

Tenants don’t face property tax or major lawful inconveniences connected to ownership.

Drawbacks of Renting

Because you’re not the proprietor, lease rising cost of living can be a constant concern. Occupants do not develop equity or take advantage of property admiration. You are also bind to landlord agreements that can restrict changes or cause stress during deed renewals.

Key Factors to Think About When Deciding Between Buying and Renting

Financial Stability and Budget Planning

Your revenue security and the capacity to pool a deposit considerably affect the expediency of buying. If your savings don’t extend past a few months’ lease, leasing might be more secure up until your financial ground strengthens.

Month-to-month budgeting needs to consist of EMIs plus real estate tax and maintenance if you acquire.

Duration of Stay and Living Preferences

Planning to stay in Delhi for 5 years or even more normally favors buying, allowing you to recover costs via cost admiration and rent cost savings. If you anticipate frequent moves or work unpredictabilities, renting out deals required flexibility.

Some favor the liberty of possession to personalize their home; others focus on easy living in leased rooms.

Market Timing and Future Expectation

Offered the ongoing framework press and low-interest rates, lots of experts suggest 2025 is a practical time to buy property in Delhi, particularly in emerging locations. However, supposition feeds on possible market modifications or slower appreciation.

Continually checking neighborhood realty patterns can assist decide whether to lock in an acquisition or wait.

Legal and Documentation Factors to consider

For purchasers, completely vet home titles and possession files and confirm compliance with government norms. Customers must consult sources like Godrej Properties’ guide on important documents for buying in Delhi.

Renters must ensure transparent occupancy contracts, clear terms on maintenance, rental deposits, and time-bound rent rise conditions.

Final Words

Choosing to buy property in Delhi or lease depends mostly on your economic health and wellness, lifestyle needs and future strategies. Getting deals long-lasting security and financial investment advantages but requires considerable cash upfront and perseverance. Renting out supplies flexibility and lower prompt costs yet lacks equity and ownership advantages.

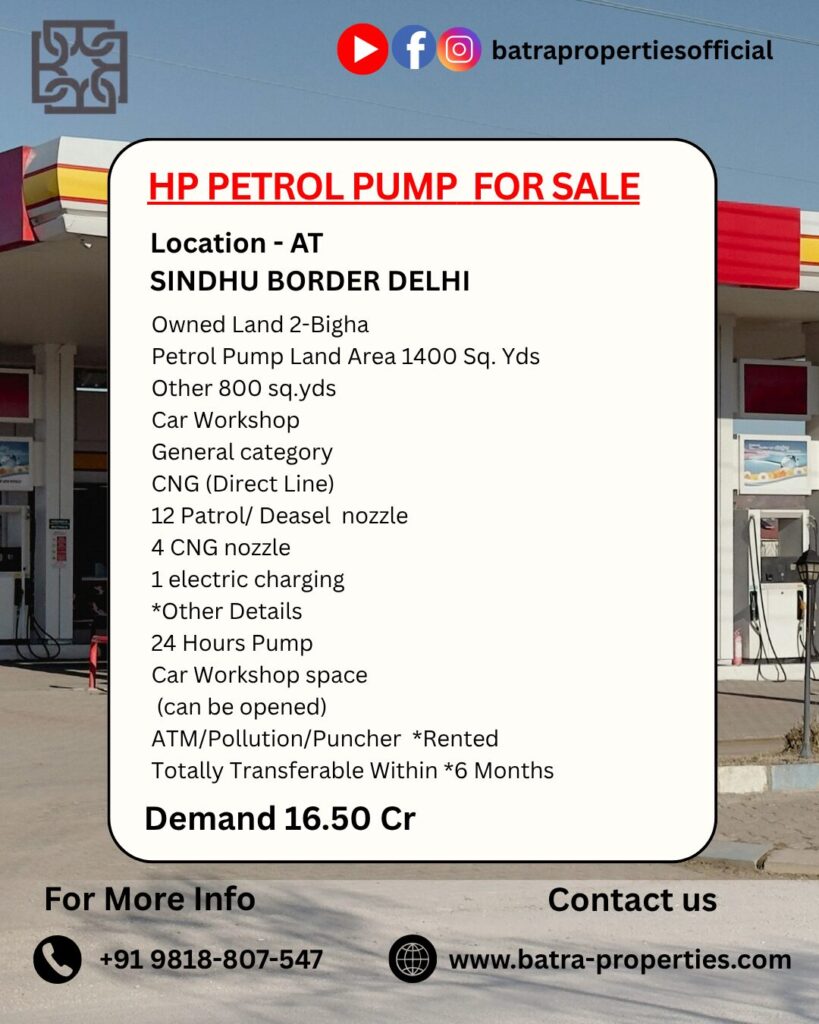

Before making a move, contrast your monthly spending plan, for how long you intend to remain, and convenience with market risks. To navigate this essential action in your life, think about expert assistance and trusted developers like Batra Properties, renowned for assisting newbies with Delhi’s property options meticulously and honestly.

Finding the ideal home or service should supply satisfaction and fit your objectives for 2025 and beyond. Your wise option currently can form your life in the capital for many years.