It’s not a simple choice to purchase Property in India. Prime metro locations like Property in New Delhi is experiencing a boom in the industry, and many people see it as a chance to increase their portfolio. But jumping into real estate without knowing the legal aspects can be problematic. A dream home might become a shocking if you encounter fraud, extra wait, or other legal issues. For this reason, the greatest initial step is to understand the correct legal advice. This hand-book will give you seven essential recommendations for a successful and secure investment in your Property in New Delhi or anywhere in India

Understanding the Rules of Indian Real Estate Law

Summary of Property Laws in India

India has a complex web of property laws. Among various acts, the most important rules are the Income Tax Act, the Transfer of Property Act, and the RERA Act. It makes developers register projects and disclose all details upfront. The Transfer of Property Act offers direction on how title moves from seller to buyer. Tax regulations have an important role in finding how much you owe in income and capital gains taxes. Understanding these rules can help you to know scams and protect your investments.

Recent Legal Reforms and Their Impact

In recent years, India introduced several legal amendments. For example, RERA’s updates now tighten rules for developers, making sure they deliver as promised. The Prohibition of Benami Transactions (Amendment) Act aims to put an end to illegal property transactions. These changes are designed to reduce fraud and create a safer experience for consumers when buying property. It also speeds approval processes and resolves grey areas, therefore increasing the transparency of the whole procedure.

Importance of Legal Due Diligence

Before buying any property, do a proper legal check. This procedure is called due diligence. It consist of verify land ownership and land title. Though a property might seem excellent on paper, it can have hidden legal problems. Neglecting this action could result in ownership conflicts, overdue levies, or perhaps future eviction notices. Treat legal due diligence as a crucial element of your purchasing strategy always; your peace of mind hinges on it.

Conducting complete Property Verification

Checking Ownership and Title Name

Verify who truly owns the property. Check original title deeds and recent property sale records. Public land records or online portals can help. Ask for existing sale agreements or receipts that confirm transfer of ownership. When ownership is confusing, it’s a sign to be cautious. Never buy a property without making sure you’re getting a clean, undisputed title.

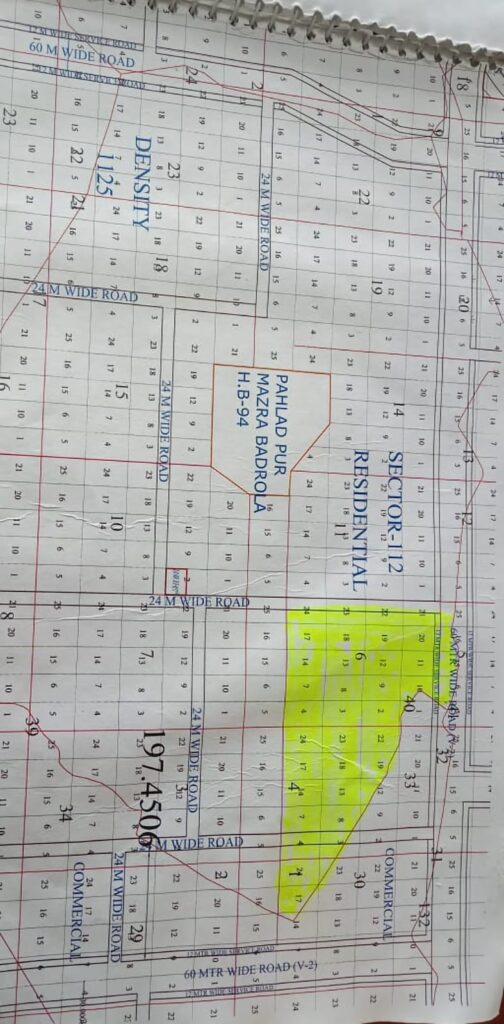

Verifying Land Use and Zoning Rules

Every plot of land has a designated use—residential, commercial, agricultural etc. Confirm this with local authorities. Look at permissions and zoning certificates, it shows whether construction is allowed. Buying a property that violates land use laws can lead to heavy fines or demolition. So, always check for approved land use before signing any papers.

Checking out Encumbrances and Liens

An encumbrance is a claim on the property—like a mortgage or lien—that limits free ownership. Official land records can help you to ascertain whether the property has any encumbrances attached. You can inherit those obligations if a property has current mortgages or liens. Resolving such debts helps you to escape financial loss or legal actions going forward.

Legal Documentation and Agreements

Understanding the Sale Deed and Other Key Documents

The primary document transmitting ownership is the sale deed. It must include thorough descriptions of the buyer, seller, and property. Check for legal definitions, registration information, and signatures. Other papers include possession letters, power of attorney, and sales agreement. Knowing these will help you to avoid unexpected events later on.

Drafting and Reviewing Contracts

Always have a qualified lawyer go over your contracts. Before signing anything, inspect the clauses. Search for payment terms, possession date, penalties for delay, and methods for dispute resolution. Your rights are protected by a properly written contract, which also defines expectations for both parties.

The Role of Stamp Duty and Registration

Stamp duty is a state tax paid during property registration—usually a percentage of the property value. Failing to pay this can make the sale invalid. Registration makes the transfer official and legally valid. It’s essential to complete this step at the local registry office. This record will serve as proof of your ownership forever.

Involving Expert Legal and Real Estate Professionals

Choosing Professional Legal Advisors

Choose an experienced, well known property lawyer. Check internet directories or inquire about references. An experienced lawyer helps verify titles, prepare contracts, and manage legal matters. Their knowledge guarantees you will never overlook any concealed hazards.

Working with Qualified Real Estate Agents

Always deal with licensed agents. Verify their registration under property broker laws. Certified agents adhere to regulations safeguarding consumers. They can guarantee transparency, negotiate better rates, and assist in locating the suitable property.

Consulting with RERA Registered Developers

Make sure to buy only from developers who are registered with RERA. These builders adhere to the law, pay their taxes on time, and complete projects as promised. By choosing a RERA-registered builder, you minimize the risk of fraud and gain better legal protection.

Understanding Property Financing and Its Legal Aspects

Learning About Home Loan Regulations

When applying for a mortgage, understand the legal terms involved. The bank require to sign a mortgage agreement. It’s essential to read the fine print. Also, legal disputes against the property can delay or block your loan approval. Clear titles and proper documentation are critical.

Tax and Regulatory Compliance

Be aware of taxes like capital gains or GST. Selling or inheriting property triggers tax obligations. For under-construction properties, GST applies, changing the overall purchase cost. Knowing these rules prevents unexpected bills later.

Legal Tips for Co-Ownership and Joint Purchases

If buying with others, draft clear agreements. Specify each person’s share, rights, and responsibilities. Address inheritance and succession issues upfront. Proper legal planning avoids disputes in future.

Staying Away from Frequent Legal Mistakes

Identifying and Stopping Frauds

Be cautious, as scammers often produce fake documents or counterfeit land titles. Look out for prices that seem too good to be true, forged signatures, or missing paperwork. Always take the time to double-check and rely on trusted sources. Stick to verified legal records instead of unofficial claims.

Legal Challenges in Urban vs. Rural Real Estate

Rural land often has additional issues—like unclear land titles, land rights, or government clearances. Urban properties usually have more transparent legal records but still require due diligence. Different checks are needed depending on location.

Dealing with Arguments and Legal Issues

If a dispute arises, try to resolve it first. Have a conversation or meet with the other parties to find a solution. If that doesn’t work, you might need to take legal action, such as filing a claim or seeking help from the court. Consulting with an experienced lawyer can help you navigate these situations more effectively.

Conclusion

Buying property in New Delhi can be rewarding but tricky without proper legal checks. These seven tips cover the basics: laws, verification, paperwork, professional help, financing, and common mistakes. Knowing them protects your investment and saves you trouble down the road. The more you understand about legal protections, the more sure you’ll feel when buying something so important. Your smart choices today secure your property dreams tomorrow.

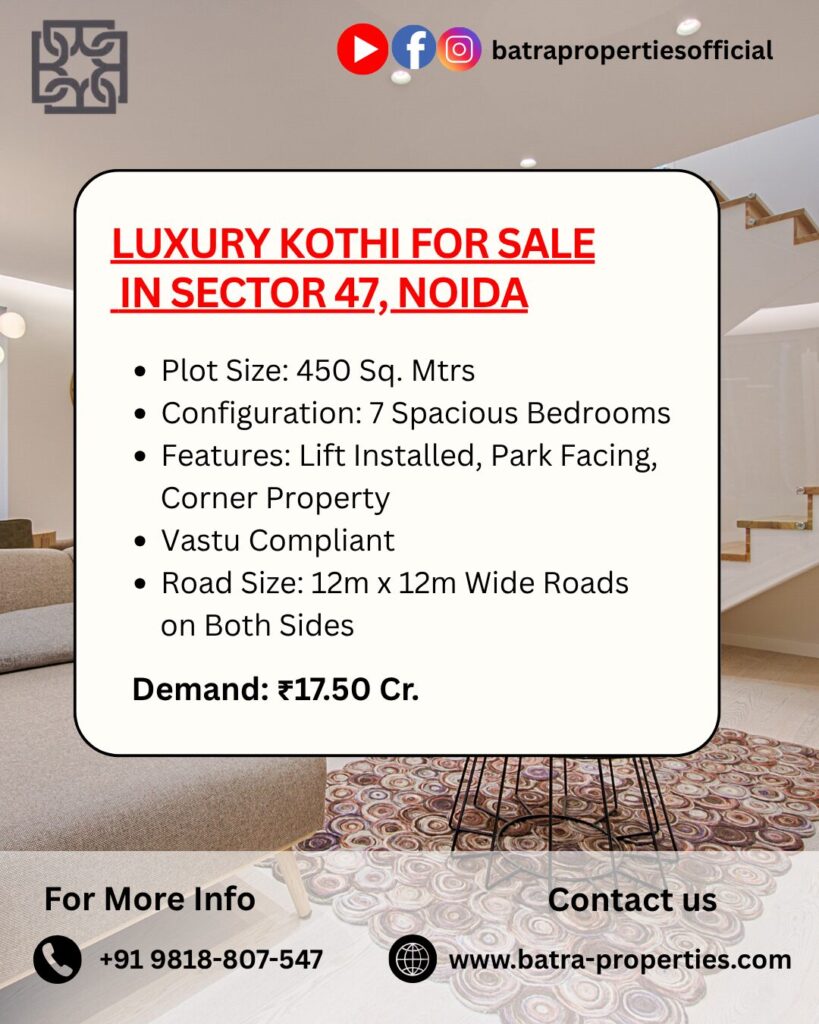

For trusted advice and secure investments in Property in New Delhi, connect with the experts at Batra Properties.